Issued 27th April 2017

The International Salvage Union (ISU) statistics for 2016 indicate an industry providing an increased number of vital services to the shipping industry but, at the same time, gross revenues have fallen significantly adding to the commercial pressure on members of the ISU.

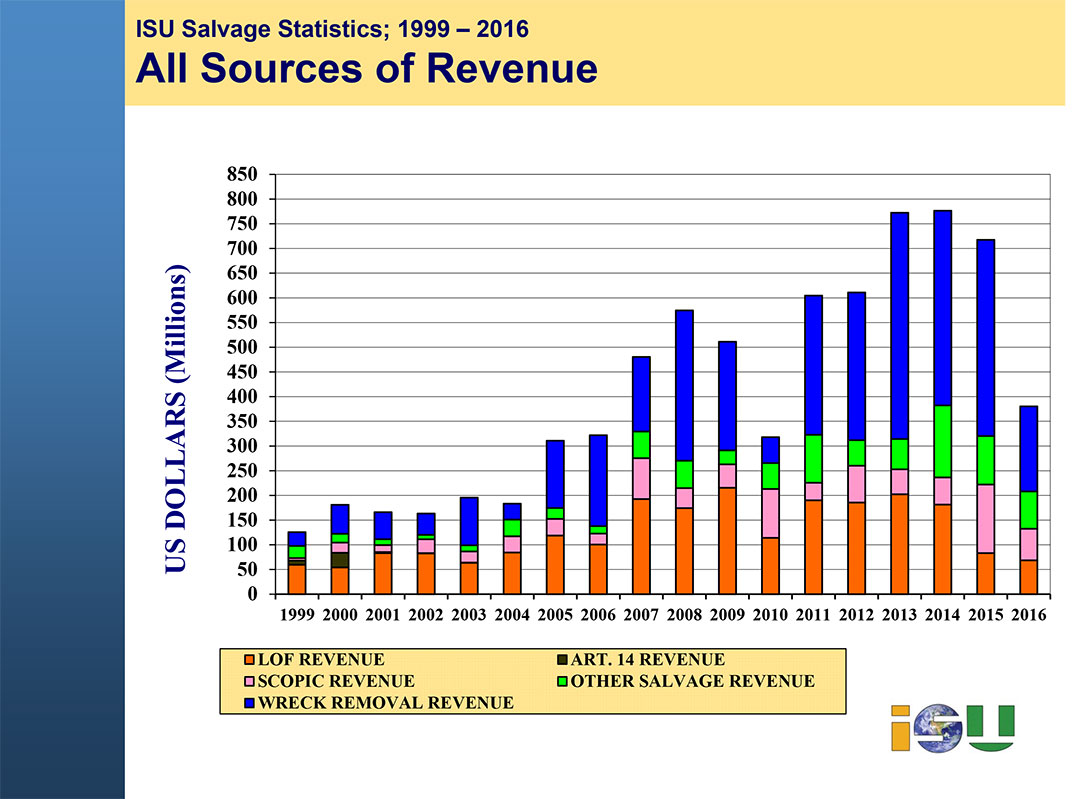

Gross revenues for ISU members in 2016 from all activities fell to US$ 380 million. It compares with US$ 717 million in 2015, a drop of 47%. The statistics are for income received in the given year but which may relate to, in some cases, operations from a preceding year.

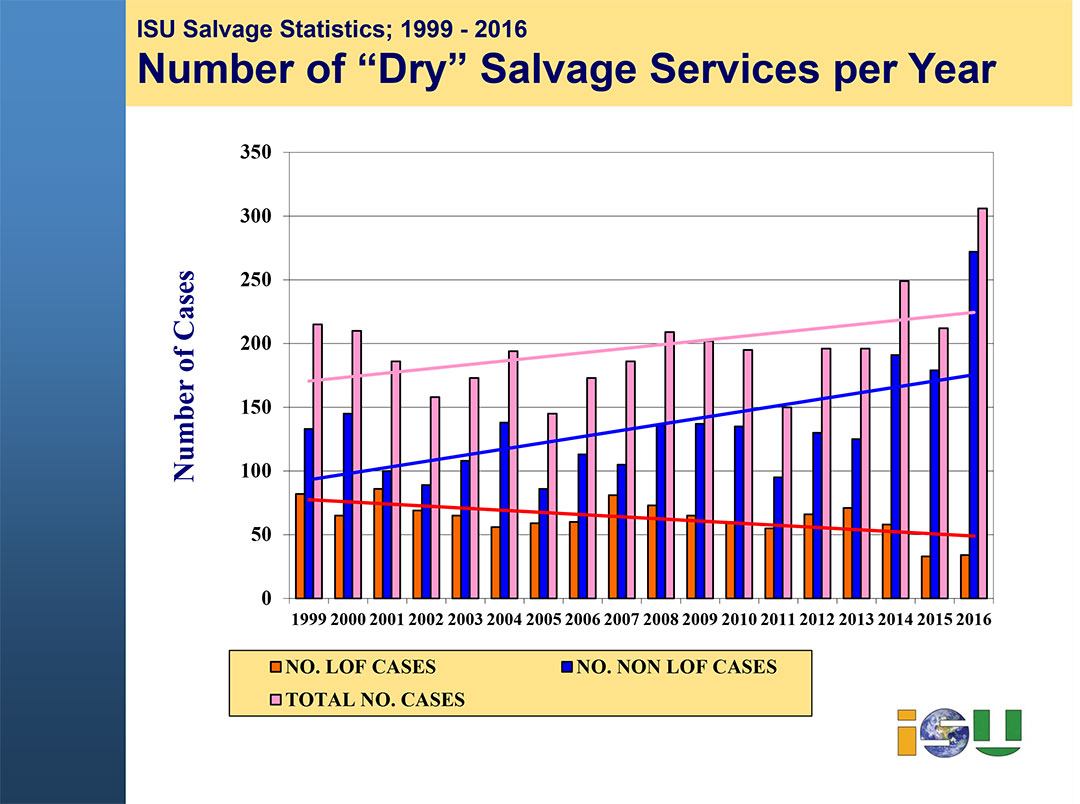

The total number of ‘dry salvage’ services recorded in 2016 was 306. It is the highest number since 1999 and compares to 212 services in 2015.

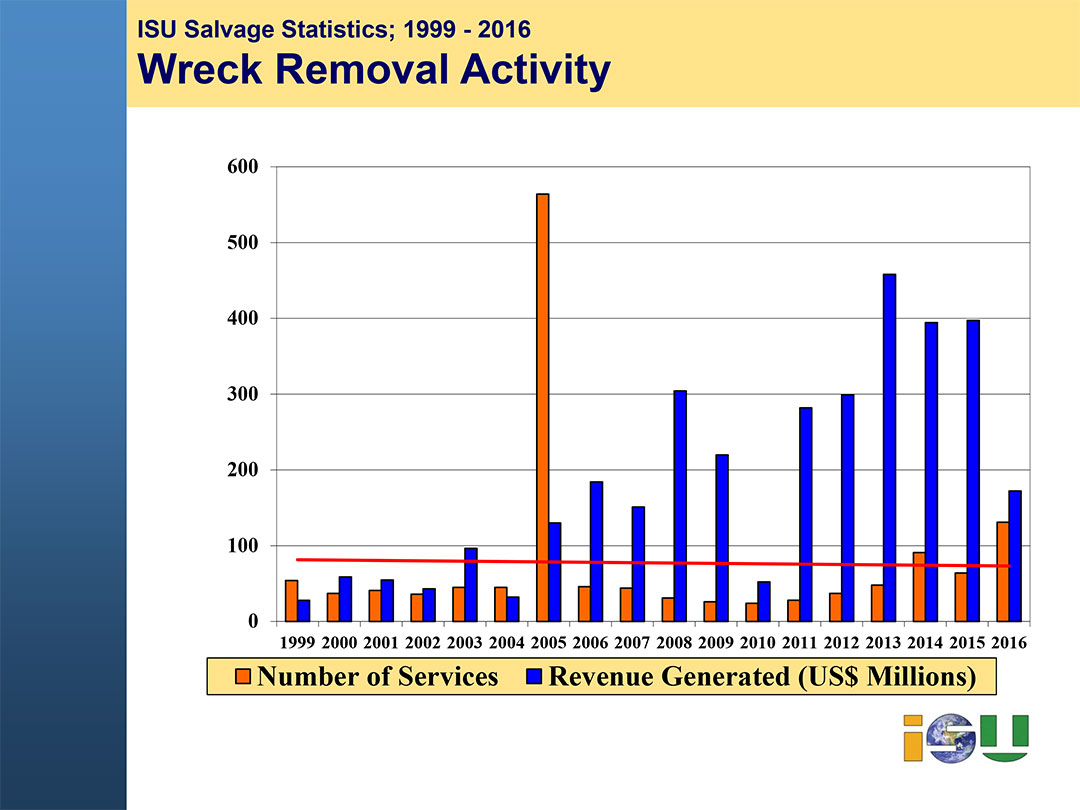

Wreck removal income has grown during the past decade, however revenue from this source in 2016 fell to US$ 172 million, down from US$ 397 million in 2015 – a fall of 57%. It represented 45% of all ISU members’ revenue in 2016. It is the first time in four years that wreck removal revenue accounted for less than half of all revenue. The 2016 statistics record 131 wreck removal jobs compared with 64 in 2015.

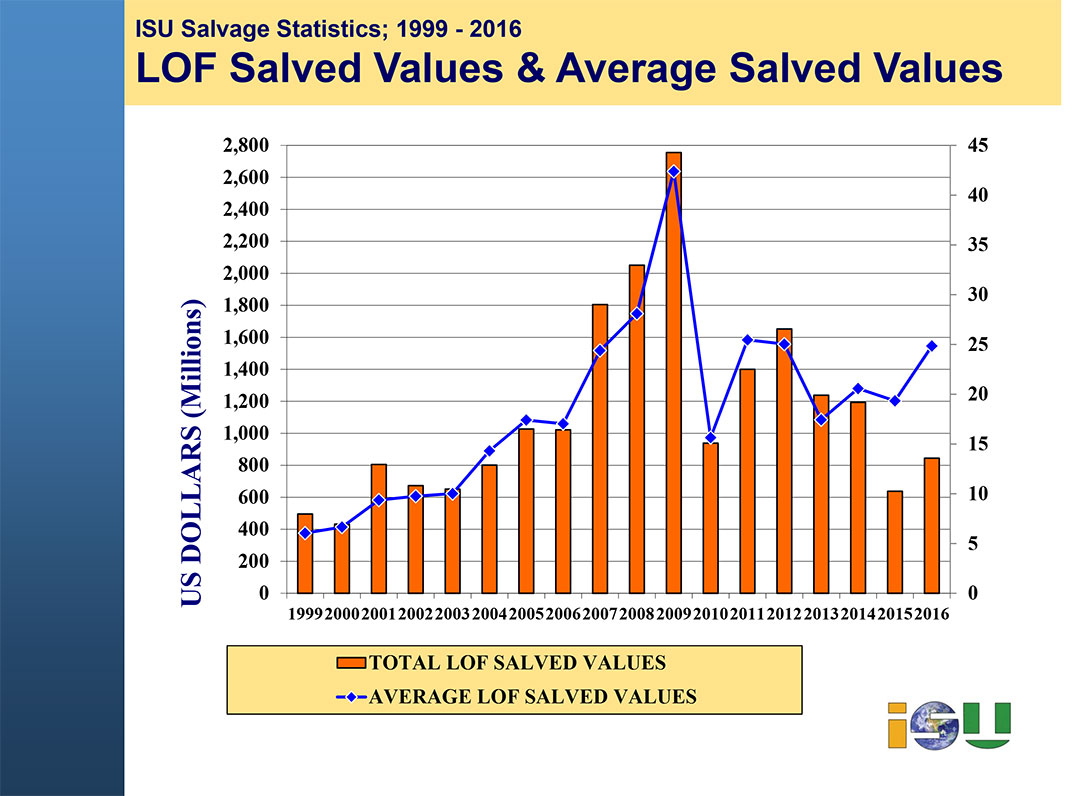

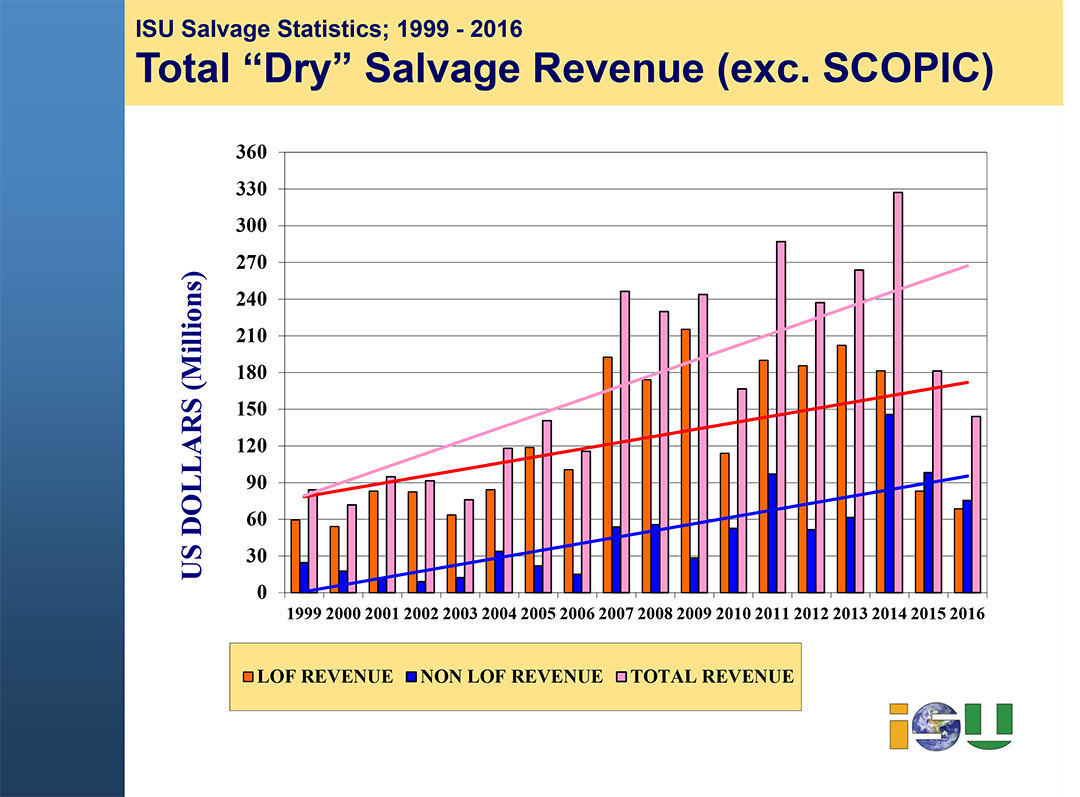

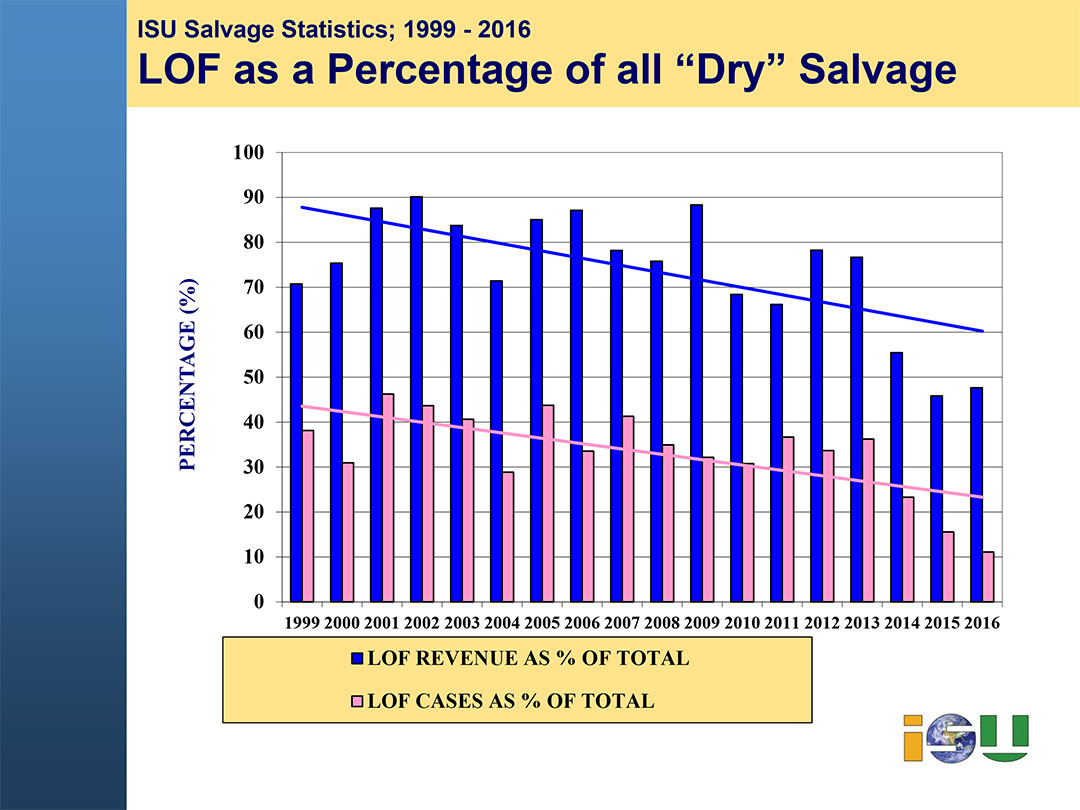

Revenue from Lloyd’s Open Form (LOF) cases at US$ 69 million is the lowest since 2003 and continues the downward trend of LOF. The number of LOF cases that realised revenue in 2015 was just 34 compared to the all-time low figure of 33 for 2015. Average revenue from LOF cases, which includes SCOPIC revenue, was US$ 3.90 million, down 40% from 2015.

At the same time, revenue from operations conducted under contracts other than LOF was also down at US$ 75 million, a fall of 23% on 2015. Average revenue from non-LOF contracts was US$ 277,000 a fall of 50%.

Revenue from LOF cases as a percentage of the total of all “dry” salvage revenue was 33% and is a continuation of the decline. The figures were 46% in 2015 and 55% in 2014. Similarly, the number of LOF cases as a percentage of all “dry” salvage cases is the lowest at 11% in 2016 (16% in 2015). It reflects the continuing trend to use other commercial contracts and terms in place of LOF.

Revenue derived from the Special Compensation P&I Club Clause (SCOPIC) in LOF cases decreased significantly to US$ 64 million compared to US$ 139 million in 2015, a fall of 54%.

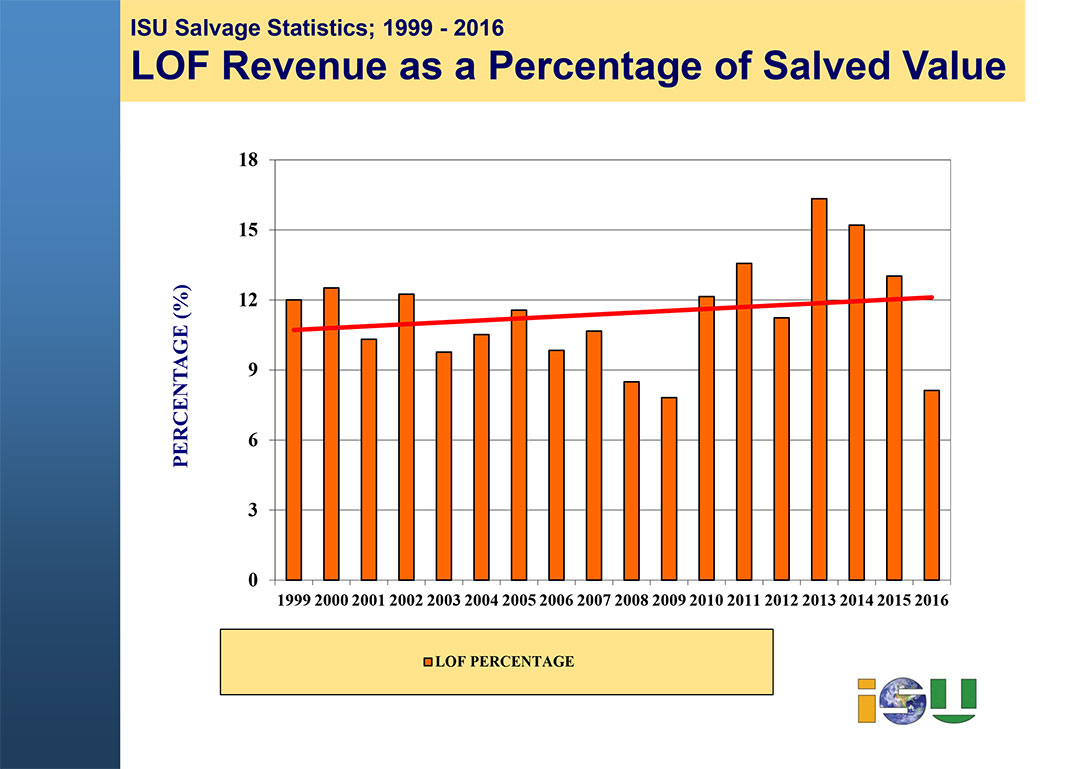

Total salved values (ship and cargo) in LOF cases rose to US$ 845 million in 2016 up from US$ 638 million in 2015. The average value salved in LOF cases also rose to US$ 25 million. The figure has stayed within the US$ 15 – 25 million band since 2010. Average LOF revenue expressed as a percentage of average LOF salved value has fallen for the third consecutive year and was 8.13%. LOF revenue data includes both LOF awards and settlements.

Commenting on the statistics, ISU President, John Witte said:

“These numbers show a contradiction. It would be expected that a 47% drop in total revenue would have been brought about by a reduction in the number of cases. However, the total number of cases, both ‘dry salvage’ and wreck removal, increased from 276 in 2015 to 437 in 2016. Clearly, therefore, the average revenue from all cases declined. It may be due to fierce competition forcing salvors to undertake cases for much lower returns. And general commercial pressures across shipping could be squeezing the margins.

“One bad year does not make a trend and these statistics again show the variability of our industry and the fluctuations in the sources of revenue. But it seems there has been a fundamental shift downwards.

“Despite the pressure on salvors’ revenue, members of the ISU continue to stand ready to provide vital services that benefit shipowners and insurers by mitigating loss. And a sustainable salvage sector is very much in the interests of the shipping industry.”